PC familiesboth travel,stay homefor eclipse By Burton ColeKenzi Zmyslo of Alexandria and family traveled to Connersville, Ind., to put themselves in the pathway of last week’s total solar eclipse.“Definitely worth the drive,” she said. “It was surreal experience. Bats came out, and my…

News Staff

PC familiesboth travel,stay homefor eclipse By Burton ColeKenzi Zmyslo of Alexandria and family traveled to Connersville, Ind., to put themselves in the pathway of last week’s total solar eclipse.

News

News Staff

By Carolyn Reid FALMOUTH — A special meeting focusing on the building for the county fire department started Tuesday’s Pendleton County Fiscal Court…

News Staff

By Burton Cole FALMOUTH — A broken crossarm on a utility pole in a remote area south of town caused a power outage that kept the city and southern…

News Staff

DECEMBER 2023 EVENTS

Weekends Thursday, November 30 - Sunday, December 17, Stonewood Gardens, Winter Wonderettes. Thursdays - Saturdays, 7 p.m., Sundays 2:30…

Local News

News Staff

Bracket BeaterThe University of Connecticut's 75-60 victory over Purdue in the NCAA men's basketball national championship last week gave Dave Maier the boost…

News Staff

Blanket CreekScripture was from Genesis 3 titled The Fall of Man. A lot of people are afraid of snakes (me!), however, Eve didn’t seem to be afraid of the…

News Staff

BUTLER — Creature Feature runs twice monthly featuring some of the dogs available for adoption at the Pendleton County Animal Shelter. Contact them at 859-472-…

Sports

News Staff

Bracket BeaterThe University of Connecticut's 75-60 victory over Purdue in the NCAA men's basketball national championship last week gave Dave Maier the boost…

News Staff

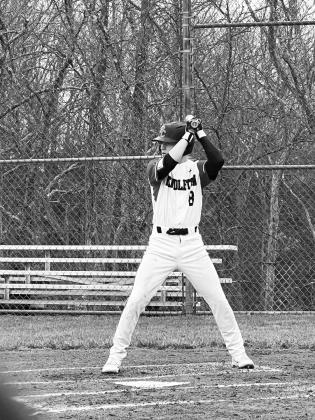

By: Ethan VerstThe Wildcats baseball team moved to 1-8 on the season as they picked up a huge win in their only game last week against Lewis County. The…

News Staff

By: Sam McClanahanFor the second time in his collegiate basketball career, Dontaie Allen will be entering the NCAA transfer portal.Allen, 23, leaves Western…

Obituaries

News Staff

Geneva K. Hutchison, 83, of Falmouth, KY passed away on Wednesday, April 17, 2024, at St. Elizabeth Hospital in Edgewood. She was born in Falmouth on…

News Staff

Laura Brayden Townsend, 77, of Crestview Hills, KY, passed away on Sunday, April 14, 2024, at her home, after multiple courageous battles with cancer.Born on…

News Staff

Laura Brayden Townsend, 77, of Crestview Hills, KY, passed away on Sunday, April 14, 2024, at her home. Funeral arrangements are pending with Woodhead…